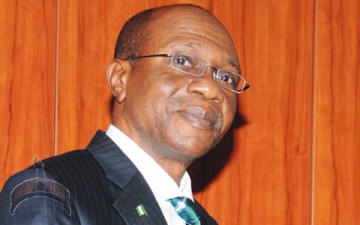

The Nigerian stock market witnessed a powerful rebound on Tuesday, as investors welcomed the news headlines of the suspension of the CBN Governor, Mr Godwin Emefiele, by President Bola Tinubu.

President Bola Ahmed Tinubu suspended Mr Godwin Emefiele, CFR, last Friday explaining that it was a result of the ongoing investigation of his office and the planned reforms in the financial sector of the economy.

It seems that industry sentiment was boosted by the expectation that the suspension would pave how for a far more transparent and accountable monetary policy, along with a possible devaluation of the naira to help ease the stress on the exchange rate and inflation.

How industry reacted

The benchmark All-share index soared by 4% or 2,232.58 points to close at 58,163.55 points, while industry capitalization increased by N1.22 trillion or 4% to be in at N31.670 trillion.

- The suspension of the CBN Governor also triggered a rally in the banking sector, as investors anticipated an optimistic effect on the liquidity and profitability of the banks.

- The NSE Banking Index rose by 6.7% to lead the sectoral performance, followed closely by the NSE Insurance Index which gained 5.4%.

- The NSE Consumer Goods Index and the NSE Oil and Gas Index also advanced by 4.3% and 3.9%, respectively.

Investors also poured into the industry as the worthiness of deals transacted rose 55% set alongside the last trading day while the number of deals also rose by about 106%. Market Turnover was up by about 216%.

Stocks Gain big

The marketplace breadth was positive, as 62 stocks appreciated among which the very best 10 gained above 9% on the day.

- The most truly effective gainers were Access Corp, GT CO, NASCON, Zenith Bank, and Lasco which gained 10% respectively.

- The most truly effective losers were Elah Lakes (-10%), John Hold (-10%), Caveraon (-4.6%), Veritas (-4.35%), and Honeywell Flour (-4.29%).

- The All Share Index is 13.49% up year up to now as investors continue steadily to react positively to development in the economy.

FUGAZ on a move: The trio of Access Bank, GTCO, and Zenith Bank are now up 68%, 33.9%, and 28.3% year to date. UBA and FBNH which can make up the FUGAZ may also be up 33% and 43% year up to now respectively.

Optics

The suspension of the CBN Governor is a major development that may have significant implications for the Nigerian economy and the financial markets.

- Analysts have expressed mixed views on the impact of the suspension, with some arguing that it could create uncertainty and instability in the policy environment, while others opining that it could usher in a brand new era of reforms and growth.

- The marketplace will continue steadily to monitor the specific situation closely and react accordingly to any new developments or announcements from the presidency or the CBN.

Ọmọ Oòduà Naija Gist | News From Nigeria | Entertainment gist Nigeria|Networking|News.. Visit for Nigeria breaking news , Nigerian Movies , Naija music , Jobs In Nigeria , Naija News , Nollywood, Gist and more

Ọmọ Oòduà Naija Gist | News From Nigeria | Entertainment gist Nigeria|Networking|News.. Visit for Nigeria breaking news , Nigerian Movies , Naija music , Jobs In Nigeria , Naija News , Nollywood, Gist and more