Key highlights

- Analysts advise that CBN needs to work with the non-cash vendors to take the demand for cash.

- Scarcity experienced was the failure of Banks not having cash but non-cash outlets(POS, online) failing due to excessive demand.

- FG urged to invest in placing Nigerians in high-value global value chains to make the naira competitive.

The Naira Redesign Policy of the Central Bank left a bitter taste in the mouths of Nigerians. The Naira became scarce as a result of the naira notes mop-up, which forced many businesses to increase prices or incur costs from lost IT-related transactions to delayed projects due to the scarcity.

The resulting scarcity shows that the Central Bank of Nigeria must be better prepared next time. However, there are also policy roots that must be laid fiscally by the Government to make Nigeria competitive and not feel the brutal effect of a monetary demonetization, as experts tell Nairametrics for this article.

The inflation following the policy has remained unabated, and the money supply has surged to a record high. Although the currency in circulation has fallen to N982.1 billion as of February 2023, the decline in circulating currency is largely due to the CBN cash swap and naira redesign policy.

Reasons for the policy

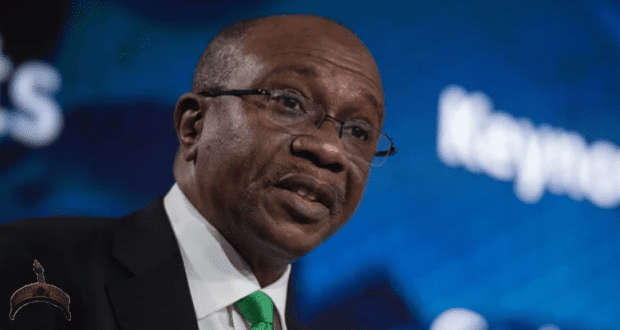

During an MPC press briefing in October 2022, the CBN Governor, Godwin Emefiele, noted that the volume of higher denominations in the economy was fueling the rise in inflationary pressure. He stated that the apex bank was going to gradually reduce the volume of N500 and N1,000 in circulation.

The President, Muhammadu Buhari, however, stated that the naira scarcity suffered by Nigerians was due to unscrupulous banking officials entrusted with the process of implementing the new monetary policy.

Reduced Circulation

Nigeria’s currency in circulation fell to a record low of N982 billion in February 2022 down from N1.39 trillion recorded in January 2023, representing the lowest level since November 2008, according to data obtained from the Central Bank of Nigeria (CBN).

The total amount mopped up since the policy to remove old naira notes from circulation is an estimated N2 trillion in two months. The total currency in circulation as of December 2022 was just over N3 trillion.

The decline followed the CBN’s aggressive monetary policy to phase out old currency notes and introduce limited new notes into the economy.

How to prevent scarcity next time

Patience, a restaurant owner, told Nairametrics that the decision of the supreme court came at a needed time.

She said, “I contemplated sub-leasing space in my shop, but the cashless policy did not work as I had network issues”. However, not everyone believes the policy failed.

Mr. Kala Aja, a financial analyst, told Nairametrics that the policy did not fail, urging that the CBN work with non-cash vendors on liquidity challenges.

“It (Naira Redesign) didn’t fail, the Naira was scarce as emphasized by the CBN Governor.” “CBN needs to work with the non-cash vendors to take the demand of cash.

“This was not a failure of Banks not having cash but non-cash outlets (POS, online) failing due to excessive demand.

On avoiding the chaos caused by the Naira redesign and the need for one, Dr. Andrew Nevin, Advisory Partner & Chief Economist of PricewaterhouseCoopers (PwC), told Nairametrics that FG should follow the strategy of placing Nigerians in high-end Global Value Chains (GVCs) as emphasized by PwC.

The solution envisages that Nigeria’s participation in GVCs will make the country more prosperous, which says:

“25,000 Brain Exports each in five years (25% of the call center workforce) is achievable for medium-skill opportunities like animation and gaming.

“However, high-value opportunities like programming and software development need special attention, and Nigeria can produce as many as 1.5 million of these in the next five years.

The programmer target is in line with capturing 17% of the software development jobs expected to hit the market in the next ten years.”

Bottomline

Nairametrics research concludes that the reduction in Nigeria’s currency in circulation following the CBN’s aggressive monetary policy to phase out old currency notes has had both positive and negative effects.

On one hand, it has resulted in a reduction in currency outside banks and an expected improvement in the potency of monetary policy tools.

On the other hand, it has exacerbated cash scarcity, threatening a slowdown in the country’s gross domestic product and increasing hardship for Nigerians.

Urging that the government has taken action to address the issue, but it remains to be seen how effective they will be.

Policymakers need to balance the need for reducing inflationary pressure with the need to mitigate the negative effects of monetary policy on the general population.

Meanwhile, despite the Central Bank’s gains in mopping the currency outside banks, Nigeria’s total money supply also increased, echoing Nairametric’s earlier warnings on India’s example with a demonetization policy in recent years.

Nigeria’s money supply (M3) rose to N53.3 trillion in February 2023 from N52.16 trillion recorded at the beginning of the year, representing a 2.2% increase year to date. Compared to the previous month, the money supply increased marginally by 0.3% from N53.14 trillion.

Ọmọ Oòduà Naija Gist | News From Nigeria | Entertainment gist Nigeria|Networking|News.. Visit for Nigeria breaking news , Nigerian Movies , Naija music , Jobs In Nigeria , Naija News , Nollywood, Gist and more

Ọmọ Oòduà Naija Gist | News From Nigeria | Entertainment gist Nigeria|Networking|News.. Visit for Nigeria breaking news , Nigerian Movies , Naija music , Jobs In Nigeria , Naija News , Nollywood, Gist and more