The House of Representatives has asked the Central Bank of Nigeria (CBN) to immediately suspend the planned implementation of its new policy on revised cash withdrawal limits for individuals and corporate organizations.

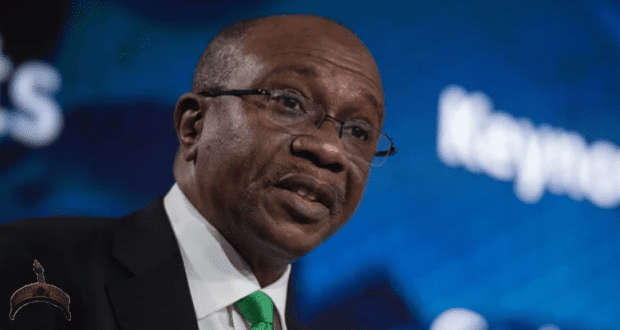

The members of the lower house who appear unhappy, also summoned the CBN Governor, Godwin Emefiele, to appear before it on Thursday over the new policy which is expected to take effect on January 9, 2023, and a series of other policies churned out lately.

This is coming barely 24 hours after the senate in a related development, expressed concerns about the policy, with the Senate President, Ahmed Lawan, cautioning the apex bank not to jump into the policy at once as many Nigerians will be affected.

He also asked the committee on banking to discuss the matter with the 2 Deputy Governors of the CBN during their screening holding before next week.

The resolution by the house was passed during a plenary session on Thursday following the adoption of a motion of urgent public importance moved by Aliyu Magaji, a lawmaker from Jigawa.

Small businesses and poor rural dwellers will be negatively impacted

Magaji and the majority of the lawmakers kicked against the policy saying that it was too harsh and sudden for Nigerians, especially the poor majority residing in the rural areas.

Magaji, who led the debate on the motion, said small businesses are drivers of Nigeria’s economy and most small business owners transact their businesses, trade, and transactions in physical cash and are in most cases, not inclined to the use of electronic banking system as most of them are either illiterate, half-educated or not learned at all.

- He said, “These set of Nigerians who are the drivers of Nigeria’s economy will be seriously negatively affected and their business and source of livelihood may be seriously impaired with these new directives of CBN.

- “The new policies rolled out by CBN will hurt the already dwindling economy, and further weakens the value of Nigeria as Nigerians may resolve to use dollars and other currencies as a means of trading and thus further de valued Naira and weakens the economy.”

Lawmakers fear backlash from constituents

In his contribution to the motion, Aminu Suleman from Kano said the CBN issued the directive without taking into consideration of Nigerians in remote and rural areas.

He said lawmakers in the national assembly may be voted out by their constituents if they do not intervene and demand that the CBN suspend the policy.

- He said, “This could be an exit board for many of us if we allow this radical decision to succeed and there my voice must be heard on this.

- “There are several government chief executives in this country that have outlived the essence of their positions because I cannot simply understand how we can wake up one day and introduce this draconian approach to businesses, giving Nigerians one month to adjust their belts.

- “I think that beyond rhetoric we should search our books and impose necessary legislation to ensure we arrest the situation, we have more powers and we can look into the powers of the CBN and remove the excess powers for us that we can act on behalf of Nigerians.”

Cashless policy to help tackle insecurity

However, Ndudi Elumelu, minority leader, vehemently opposed the motion, describing the policy as the best step taken so far to tackle banditry, kidnapping, and other crimes that involved the payment of ransoms in cash.

- He said, “On the issues of cashless policy, I think that is the best thing that can happen to this country even though the timing might be difficult, we may ask for an extension of time for it to be well implemented.

- “If there is a cashless policy and people use their phones to transfer money, some of such things will not happen and that is the truth.”

For catch up

Recall that on December 6, 2022, the CBN in a new circular placed limits on over-the-counter cash withdrawals, Automated Teller Machine (ATM) withdrawals, and point of sale (PoS) withdrawals.

- The apex bank in a memo directed all banks and other financial institutions to ensure that over-the-counter cash withdrawals by individuals and corporate entities do not exceed N100,000 and N500, 000, respectively, per week.

- It also directed that only N200 and lower denominations should be loaded into banks’ ATMs.

- After the policy takes effect, all cash withdrawals above the stated limits will attract processing fees of 5% and 10%, respectively.

Ọmọ Oòduà Naija Gist | News From Nigeria | Entertainment gist Nigeria|Networking|News.. Visit for Nigeria breaking news , Nigerian Movies , Naija music , Jobs In Nigeria , Naija News , Nollywood, Gist and more

Ọmọ Oòduà Naija Gist | News From Nigeria | Entertainment gist Nigeria|Networking|News.. Visit for Nigeria breaking news , Nigerian Movies , Naija music , Jobs In Nigeria , Naija News , Nollywood, Gist and more