by Ramin Mazaheri

There are seemingly rather few commentators who understand the “real economy” (encompassed by national growth rates and employment rates), the “fake economy” (the 1%-dominated FIRE sector: finance, insurance and real estate) and crypto currency. I have seen top commentators make the most fundamental errors regarding crypto since it began a spectacular boom in April.

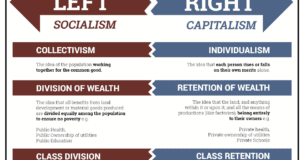

And then there is a fourth axe: socialism. Even fewer Western commentators understand socialism than crypto. I think I can make a fair claim understand enough of all four to make decent daily journalism in all areas.

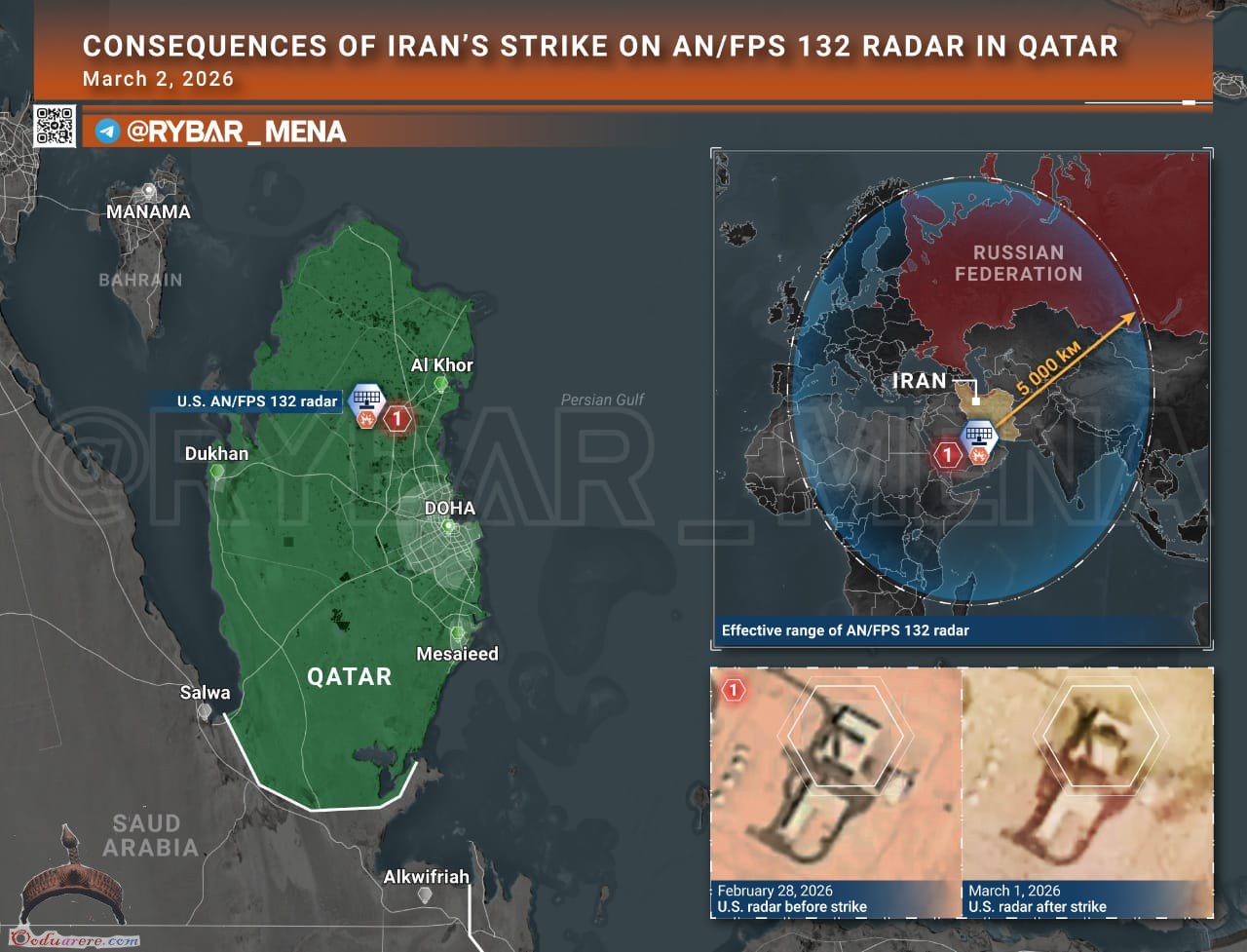

My bitcoin knowledge is the weakest, but it sure has been a fun couple weeks learning! I got turned on to crypto while searching about China’s new gold-yuan-oil exchange, which is a crippling blow to the domination of the dollar and the “exorbitant privilege” of the US to finance their deficits. Nixon took the US off gold in 1971, but the Saudis put the dollar on oil. Now that China is going to allow countries like Iran, Venezuela and Qatar – which alone comprise a huge chunk of the world’s known oil and gas reserves – to cut out the dollar, it is a whole new financial and political world. Very few bitcoiners I’ve talked to know about this development, but this is all related, certainly.

To augment my bitcoin knowledge I interviewed Manuel Valente, the director of the one brick-and-mortar store for bitcoins in Paris – Maison du Bitcoin. The timing couldn’t have been worse: it was just one hour after China announced that all 3 top bitcoin-for-yuan exchanges will be closed by September 30. Bitcoiners will likely remember this day as “Black China”, because bitcoins dropped 40% in 24 hours.

I pictured an office in chaos, and expected he wouldn’t have time to see me.

And yet he could not have been more unperturbed and genial. That should tell you something. He even gave me – a journalist with the credentials of “an Iranian government TV and leftist/anti-imperialist reporter” – more than an hour even though bitcoins were in the middle of a bloodbath.

Confirmed yet again: China knows what they are doing

Expecting an anti-China tirade, I asked him: “What’s your greatest fear?” His answer was “ICOs”.

An ICO is just like an IPO – it’s a way for a new crypto-currency to publically ask for money. It stands for “International Coin Offering,” and the coin functions the same as a stock.

What this means is that Valente approved of China’s first rattling decision earlier in the week: to ban ICOs. Many short-term investors interpreted this as “banning all bitcoins”, but those were the know-nothing, money-grubbing speculators.

The problem with ICOs is that, thanks to the technological advancement provided in February by what is now the #2 bitcoin, called Ethereum, all someone has to do to create a new crypto-currency is to add just 100 or so lines of code to Ethereum and voila. So it is too easy, and there are now perhaps 2,000 coins which aren’t Bitcoin (capital B, and the industry leader by far). And these are all totally unregulated. That means some of these new bitcoins which have been rushed to market are total scams.

“We’re in 1998,” Valente said, a reference to the dot-com boom, which produced spectacular flame-outs like pets.com. “It’s going to be a bloodbath for ICOs.”

And it should be. “95% of all these new ICOs can already be done with Ethereum.” If your product provides no technological or philosophical advantage, there’s no reason the public should need you. Some people will heed Valente’s advice – others will say they have found the 1 new coin which will hit it big and make them billionaires.

Valente suggests normal people should invest only in Bitcoin and Ethereum. “There’s space for maybe 5 or 10 cryptocurrencies,” he said. And that makes sense: you have Visa, MasterCard, Discover, and a few others which are widespread…and then some other cards that are predatory, usurious cards which should be banned.

The US Securities and Exchange Commission is headed in the same direction as China: they are looking at ICOs, seeing their similarity with IPOs, and warning that they are pump-and-dump scams.

The news of shutting down the top 3 bitcoin-yuan exchanges was the second, bigger shock. Crucially, China’s international exchange and a bitcoin mining pool are unaffected. What it means is that Chinese bitcoin holders will not able to, as of September 30, get their yuan out. That money stays in China.

That makes the Chinese government correct yet again: Valente estimated that 99% of bitcoin holding in China was purely speculative – they are not using bitcoins very often commercially, like Japan, South Korea, and others. And that makes sense: a socialist country like China has (thankfully) very few opportunities for investment for those who hold a lot of capital – you can see how bitcoins were appealing. Speculation and amassing capital is a no-no in socialism, but China is not on tough on this as they used to be.

However, what they are tough on is capital flight to foreign nations, because that is a major problem for developing countries. If money leaves the country, how can poor countries rebuild? For many years the nascent South Korea criminalized sending capital out of the country…and this forced domestic investment is how South Korea got to be a top 10 global economy. Whereas African nations, for example, whose leaders hold their money in Switzerland…they have achieved undemocratic but superbly capitalist results.

So pushing unregulated bitcoin usage in wealthy countries should be encouraged, because then bitcoins can function as an effective way to redistribute wealth. Bitcoins can be an amazing pro-socialist and anti-imperialist tool, but I don’t have much space for that here.

China is perfectly correct to suspend the outflow of an increasingly large and popular form of wealth, and to investigate ways to regulate to make sure The People aren’t harmed. That’s simply good governance.

Bitcoiners hate the Chinese right now, but the Chinese people owe their government a debt of thanks.

There is a simple, obvious compromise on the question of how to regulate bitcoins

There is only one genuine problem: how to regulate the interface between the bitcoin and fiat/paper worlds.

It is not difficult: bitcoins simply must be declared and taxed. Voila.

Some 15-year old bitcoiners are probably reading “1984” while in the totalitarian setting of high school, and they are dreaming that they can get around this. They are wrong – it is criminal and anti-social. The bitcoin community must realize that they cannot remain forever anonymous because at the point of interface – cashing out your bitcoins – that simply must be accounted under every society’s moral laws.

What bit coiners can take comfort in is this: Governments must realize that the bitcoin sphere itself must remain unregulated. The protocols cannot be tampered with…the geeks have already won.

The US and their allies are also dreaming if they think they can stop the flow of bitcoins inside the cyber sphere. That’s why bitcoins are an amazing way for countries like Iran, Venezuela and other targets of American imperialism to avert cruel, murderous sanctions. Governments truly can’t touch the bitcoin netherworld – that horse is too far out of the barn, and the barn is the size of the entire globe.

However, at the point of interface – the moment of sending bitcoins out…well, governments can easily sanction people on the individual level. So, everyone’s fascist/anti-fascist dreams aside – bitcoins ultimately will be just like any other commodity. Sadly, they can still blockade Iran, Cuba, Palestine, etc. But they can’t do that just yet, so send the Irans and the Cubas of the world some bitcoins, you early adopters!

Once we all learn more about bitcoins, people will realize these are the only solutions.

But I suppose the alternative to good sense is always possible: protracted war between nations and cybergeeks, with varying degrees of success. Such a fight means bitcoin will sill certainly not be stopped in the next week, or year.

And accept this as fact as well: If capitalists can create fiat havens in Luxembourg, the Isle of Man and the US state of Delaware, surely some nation will gladly become a bitcoin haven. That means bitcoiners can go there to put in bitcoins and take out dollars, rubles, pesos ,etc.

Forget about all-or-nothing scenarios – think short-term, like 50 years

This is one of the biggest problems when discussing bitcoins with anybody: People love to take the bitcoin question to its extreme conclusion.

Look: there is no chance that we are ALL going to be making ALL our purchases in ONLY bitcoins next month. The day when bitcoins replace all currently-accepted forms of stored wealth – paper money, gold, silver, Monet paintings – is roughly the year 2525, I’d say, so stop being needlessly argumentative.

We must realize that all these forms of wealth – gold, silver, oil, real estate, stocks, Fabergé eggs, etc. – have their place…and now you must add bitcoins to that very long list.

Look at it this way: If bitcoins ever even represent just 3% of all merchant sales…bitcoins will have a trillion dollar market valuation or more.

And that’s why, even if China does totally ban bitcoins, they can absolutely survive losing the Chinese market.

Bitcoin users are already global: Russia, South Korea, Japan and others have all said that bans should not happen and that regulations are just a few months away. Bitcoins, like the discovery of a 2nd New World, are going to have major geopolitical consequences, but I will get into that in future articles. But stop thinking that everyone is going to react like China: countries are different, and they will have different approaches.

China is certainly a bit annoyed at bitcoins, which threatens to undermine their brand-spanking new gold-backed order which we leftists have all been waiting decades for China to impose. It should be no surprise that these two drastic Chinese state decisions come so close to one another – China wants a Petroyuan and yuan-dominance.

But back to the survival of bitcoin: Yes, it would hurt to lose the Chinese market, but it is absolutely not a death blow, and the fact that bitcoins bounced back at the $3,000 mark proves this fact.

Anyway, China has already “banned bitcoins” several times, only to backtrack; China is the biggest global holder of bitcoins; I would bet good bitcoin that China is going to do what they should – freeze the situation, come up with regulations, and then get back into bitcoins. That’s what history has proven and that’s what they should do – protect the Chinese.

I would bet a smaller amount of bitcoin that China is crashing the price to buy more bitcoins, further protecting the yuan’s dominant future. Considering that China’s decision came at the same time as JP Morgan Chase’s Jamie Dimon (America’s favorite banker) declared bitcoin to be a “fraud”, dropping the price further, you have to wonder if they all aren’t in it together? We leftists hope not, China….

So, to repeat, bitcoins don’t need to wipe out the competition to be a good investment – they just need a bit of acceptance and the resulting stability that entails.

So what is stability? Well, nation-states will take forever to figure out bitcoins and the results will not be uniform. So what’s the other dominant sphere besides national governments? High finance.

Bitcoin bonds have debuted in Japan. The Chicago Securities Exchange is months away from debuting a bitcoin future. Clearly: high finance is getting on board. At Davos 2016, a Financial Times reporter asked the 1% banker-dominated audience if they were on board with bitcoins and only 1/3rd of them raised their hands. Guess what – 1/3rd is actually quite a lot in this context! One-third is enough to do what is currently happening: give bitcoin enough of an “official ok” from high finance to become a permanent financial fixture.

The Eurozone’s endemic failure and looming crisis will forever legitimize bitcoins

But nothing “backs” a bitcoin!

Well, wake up: When the European Central Bank buys 60 billion euros of bonds every month in Quantitative Easing, that’s not backed by anything like gold or silver; and they aren’t even printing the paper “gold”; they are just tapping on a keyboard and, voila.

So invisible money is already here.

Invisible money is not the problem – the problem is that it’s not being loaned down to small and medium-businesses; it’s not paying off your overvalued mortgage; it’s not creating jobs and improving the productivity and efficiency of the “real economy”…it’s going to the 1% for stock buybacks and the 1%’s phony rentier FIRE economy.

Neoliberalism and austerity have created and kept the world’s largest (and least democratic) macro-economy – the Eurozone – the most fundamentally unstable: it IS the global weak point in 2017.

Their spree of free money – which has only ballooned real estate prices and stock markets, while the mainstream media celebrate anemic 1.5% growth year after year, turning an ignorant eye to the unemployment crisis AMID labor code rollbacks AND THE decrease in purchasing power caused by the “printing” of more money – has a price, and it is about to be paid.

To put it quite simply: If the ECB’s Mario Draghi says this October, as he is expected by many to do, that Quantitative Easing will start to be tapered off…bitcoin has won.

Because I am a socialist, I am certain about what will transpire:

As soon as the high finance 1%-ers are no longer being given “free money” by QE…they will go back to doing what they did before open-ended, unlimited bond-buying: squeezing the Eurozone’s bond markets. Lacking any sort of socialist solidarity, at the mere mention of “tapering” in October, German bond rates will creep up to just 2-3%. And then France’s will rise a couple points higher, and then Spain at Italy will be back at the unsustainable 7%, and that’s when investors smell blood and want to pave the way for the Troika like in Greece. That’s where we were in 2012 and QE started.

Well, guess what? Absolutely nothing has been fixed since 2012! Why? Capitalist, and not socialist, management of the economy. What did you expect would happen, that capitalism got religion and would start doing the right thing?!

Again, instead of improving the “real economy”, bailouts and QE have done nothing for the world inhabited by the 99%.

Therefore, when the crisis hits, money is going to flood into the safe (or just “safer”) haven of cryptocurrency. Take that to the bank. Or rather take it out of the bank.

And here’s the thing: If Draghi postpones “tapering” – and the new Chinese exchange and spectacular booming of bitcoin since April make it more likely – the Eurozone is simply postponing their crisis a few more months. That’s just capitalism: Marx proved it lurches from one crisis to the next, with inequality increasing each time.

You can’t print money forever.

What many fail to realize is that the reason bitcoins exist is EXACTLY BECAUSE of this fiscal charade, which began around 1980 and which crashed in the Great Recession.

There is a reason why some now-underground Japanese tech-head waited until October 2008 to unveil his White Paper on bitcoins/block chain: it was the height of the great crash. He wanted maximum impact, reaching minds finally cracked open by the latest, inevitable, deadly crash in Western capitalism.

Secretly embedded in the very first block of bitcoin code – Block Zero – was this: A London Times front page with the headline: “Chancellor on Brink of Second Bailout for Banks”.

Wake up!

Too many think that we non-economists/non-government officials are too stupid to get economics – we do. Bit coiners aren’t all holding PhD in mathematics, and way too many have been swayed by adolescent American libertarianism instead of solid, sweating, vibrant, Socialism, but we know what the hell has been going on for nearly 4 decades. Everybody does, in fact.

And we are pissed.

And that’s why they created bitcoin. And that’s why I’m investing and you should too. Giving a dollar to them is one less in the hands of the high finance psychos who let grandmas die on gurneys in the hallways of public hospitals gutted by austerity.

If I lose it: to hell with it. It’s a donation to the cause.

But I’m going to get my money back (I sure need it): Most of the world has not yet realized that bitcoin rests upon a technological advancement (quantum computing) combined with a revolutionary philosophy (block chain). Bitcoin is simply block chain applied to the financial sphere.

Block chain is the big deal – NOT bitcoins. It will be applied to many other fields and revolutionize countless areas. Indeed, this IS the dot-com boom: block chain is going to change the world like the internet did.

We are only just seeing the results today.

Watch this space – there are simply too many astoundingly positive aspects for open-minded left-wingers when it comes to block chains and bitcoins, yet nobody is talking about it yet.

Buy in – hold.

Bitcoins will be your bailout.

Ramin Mazaheri is the chief correspondent in Paris for Press TV and has lived in France since 2009. He has been a daily newspaper reporter in the US, and has reported from Iran, Cuba, Egypt, Tunisia, South Korea and elsewhere. His work has appeared in various journals, magazines and websites, as well as on radio and television. He can be reached on Facebook.

Ọmọ Oòduà Naija Gist | News From Nigeria | Entertainment gist Nigeria|Networking|News.. Visit for Nigeria breaking news , Nigerian Movies , Naija music , Jobs In Nigeria , Naija News , Nollywood, Gist and more

Ọmọ Oòduà Naija Gist | News From Nigeria | Entertainment gist Nigeria|Networking|News.. Visit for Nigeria breaking news , Nigerian Movies , Naija music , Jobs In Nigeria , Naija News , Nollywood, Gist and more