Richest Saudi Prince Says Bitcoin Will Collapse Like Enron.

In the land of countless princes and billionaires, prince Alwaleed bin Talal may be the richest of them. He’s the grandson of the founder of Saudi Arabia, King Abdulaziz Alsaud. Based on Forbes, he’s the 45th richest man in the world. Through his venture Kingdom Holding Co, he holds stakes in a number of companies including Lyft, Twitter, Citigroup and even the Savoy Hotel in London.

He’d built a reputation for himself being an early-stage investor in technology companies like Twitter and AOL, but appears to have missed the Bitcoin plane. He once was involved with controversy after being accused of exaggerating his wealth to make it to the set of Forbes top 10 billionaires.

Agrees With Jamie Dimon

Speaking on CNBC’s Squawk Box, the prince said:

“I don’t believe in this Bitcoin thing. I think it will probably implode one day. I believe it is Enron in the making.”

Notwithstanding his reputation being an early-spotter of new and successful technology trends, the prince stated that the possible lack of a centralized governing authority was exactly why Bitcoin’s failure is certain. He’s much in accordance with Chase CEO Jamie Dimon for the reason that regard.

“It doesn’t make any sense. It’s not under the supervision of the United States Federal Reserve or some other central bank. I don’t rely on it at all. I’m in agreement with Jamie Dimon.”

Why Enron?

Enron was a textbook case of fraud – a business using accounting loopholes to provide an inaccurate picture, auditors conniving with management and a Board blind to the faults of the managers and executives. Caused by this systemic fraud was the bankruptcy of Enron and the dissolution of Arthur Andersen, that was one of many five largest audit firms on the planet at that time.

You will find hardly any similarities between a fraudulent company and a decentralized currency. The prince apparently believes that Bitcoin’s price will collapse, as Enron’s share price collapsed from $90 to under $1.

Bitcoin Threatens the ” Establishment “

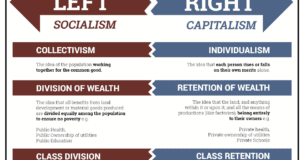

What Jamie Dimon and Prince Alwaleed don’t realize (or don’t desire to realize) is that being beyond your control of a main governing authority isn’t Bitcoin’s weakness, but its strength. We’ve seen authoritarian governments, including China, attempt to muzzle Bitcoin by turning off exchanges and proposing stringent regulation. Bitcoin threatens the establishment by letting people take control of their own money. It’s no surprise that Wall Street royalty and Middle Eastern Princes feel threatened enough to bring it down.

Source: BuyBitCoinsInNigeria Blog

Ọmọ Oòduà Naija Gist | News From Nigeria | Entertainment gist Nigeria|Networking|News.. Visit for Nigeria breaking news , Nigerian Movies , Naija music , Jobs In Nigeria , Naija News , Nollywood, Gist and more

Ọmọ Oòduà Naija Gist | News From Nigeria | Entertainment gist Nigeria|Networking|News.. Visit for Nigeria breaking news , Nigerian Movies , Naija music , Jobs In Nigeria , Naija News , Nollywood, Gist and more