On Friday, we said that the Fed will have to make an announcement before the Monday open, and we didn’t have to wait that long: in fact, the Fed waited just 15 minutes after futures opened for trading to announce the new bailout, alongside even more shocking news: the Treasury announced that New York State regulators are shuttering Signature Bank – a major New York bank – adding that all depositors both at Signature Bank, and also the now insolvent Silicon Valley Bank, will have access to their money on Monday.

And as we process the shock of yet another small bank failure (which makes JPMorgan even bigger), the Fed just issued a statement saying that “to support American businesses and households, the Federal Reserve Board on Sunday announced it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors. This action will bolster the capacity of the banking system to safeguard deposits and ensure the ongoing provision of money and credit to the economy.“

The Fed also said that it is prepared to address any liquidity pressures that may arise, which in turn has just unveiled the first bailout acronym of the new crisis: the Bank Term Funding Program, or BTFP. Some more details:

The financing will be made available through the creation of a new Bank Term Funding Program (BTFP), offering loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. These assets will be valued at par. The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.

The Fed explains that the Department of the Treasury will make available “up to $25 billion from the Exchange Stabilization Fund as a backstop for the BTFP.” And while the Federal Reserve – which was completely clueless about this banking crisis until Thursday – does not anticipate that it will be necessary to draw on these backstop funds, we anticipate that the final number of needed backstop liquidity be somewhere north of $2 trillion.

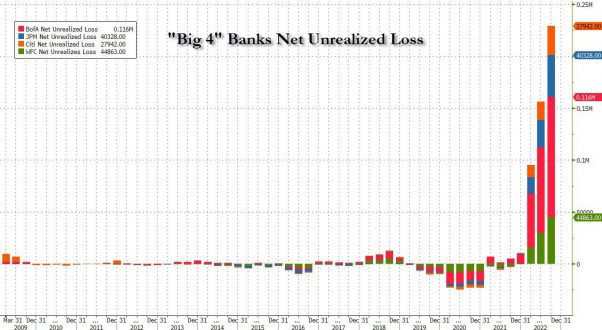

What is more notable is that the BTFP – or Buy The Fucking Pivot – facility, will pledge collateral at par, not at market value, thus giving banks credit for all those hundreds of billions in unrealized net losses, and allowing banks to “unlock liquidity” based on losses which the Fed and TSY now backstop!

On Friday, we said that the Fed will have to make an announcement before the Monday open, and we didn’t have to wait that long: in fact, the Fed waited just 15 minutes after futures opened for trading to announce the new bailout, alongside even more shocking news: the Treasury announced that New York State regulators are shuttering Signature Bank – a major New York bank – adding that all depositors both at Signature Bank, and also the now insolvent Silicon Valley Bank, will have access to their money on Monday.

And as we process the shock of yet another small bank failure (which makes JPMorgan even bigger), the Fed just issued a statement saying that “to support American businesses and households, the Federal Reserve Board on Sunday announced it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors. This action will bolster the capacity of the banking system to safeguard deposits and ensure the ongoing provision of money and credit to the economy.”

The Fed also said that it is prepared to address any liquidity pressures that may arise, which in turn has just unveiled the first bailout acronym of the new crisis: the Bank Term Funding Program, or BTFP. Some more details:

The financing will be made available through the creation of a new Bank Term Funding Program (BTFP), offering loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. These assets will be valued at par. The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.

The Fed explains that the Department of the Treasury will make available “up to $25 billion from the Exchange Stabilization Fund as a backstop for the BTFP.” And while the Federal Reserve – which was completely clueless about this banking crisis until Thursday – does not anticipate that it will be necessary to draw on these backstop funds, we anticipate that the final number of needed backstop liquidity be somewhere north of $2 trillion.

What is more notable is that the BTFP – or Buy The Fucking Pivot – facility, will pledge collateral at par, not at market value, thus giving banks credit for all those hundreds of billions in unrealized net losses, and allowing banks to “unlock liquidity” based on losses which the Fed and TSY now backstop!’

To summarize:

Signature Bank has been closed

All depositors of Silicon Valley Bank and Signature Bank will be fully protected

Shareholders and certain unsecured debtholders will not be protected

New Fed 13(3) facility announced with $25 billion from ESF to backstop bank deposits

As we said earlier on twitter, “this is a regulatory failure of historic proportions by both the Fed and Treasury. Instead of preventing billions in losses, the Fed was worrying about board diversity and Yellen was flying to Ukraine. Everyone should be sacked immediately.”

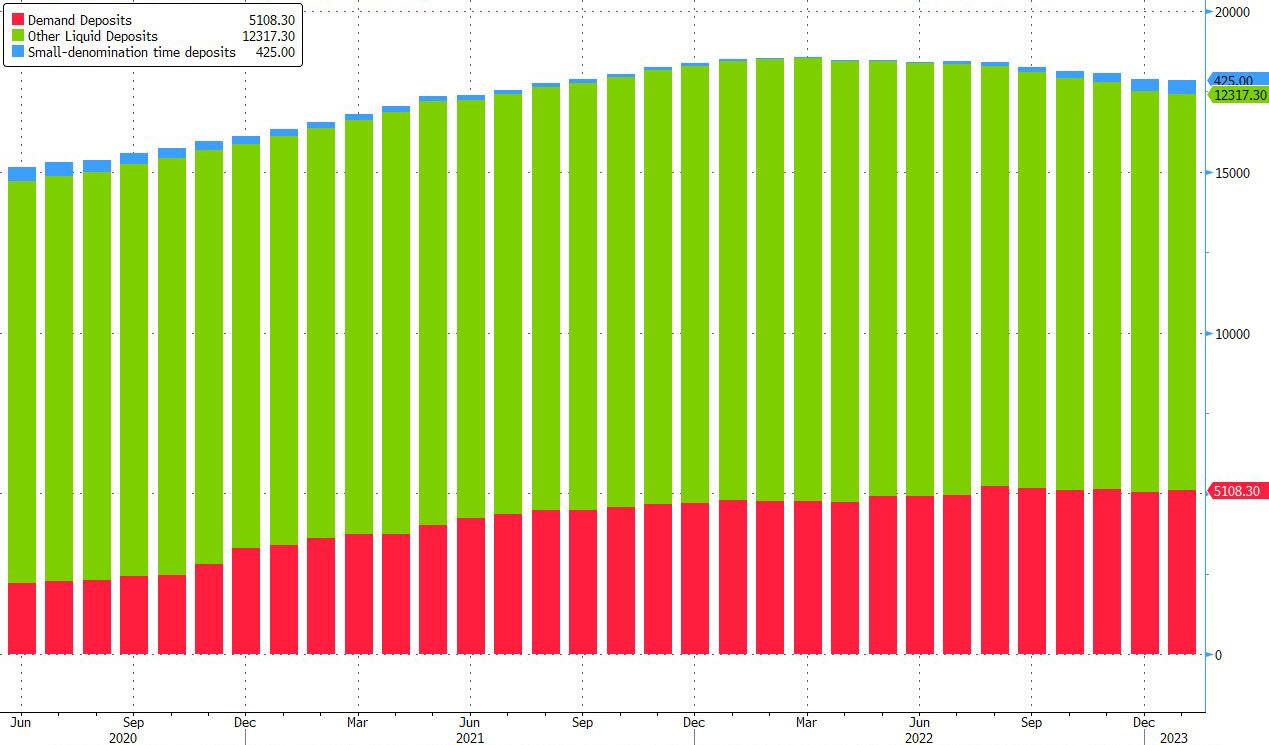

Oh, and if the Fed really thinks that $25 billion from the ESF will be enough to backstop a bank run on $18 trillion of deposits…

we wish them the best of luck.

* * *

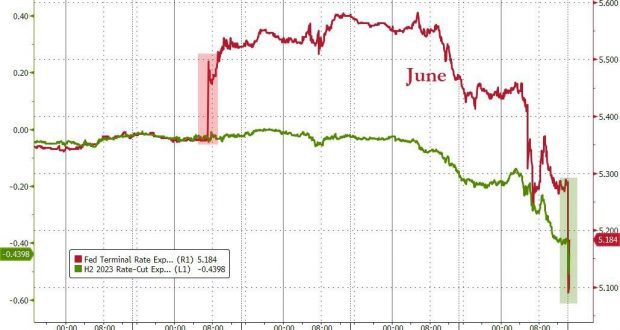

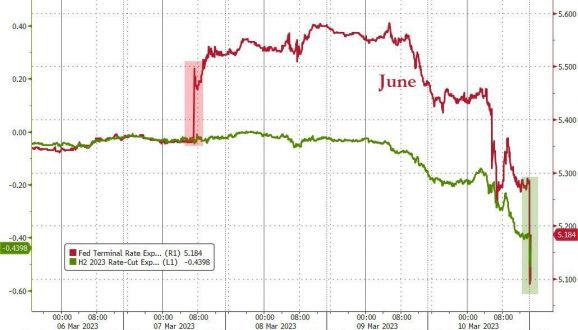

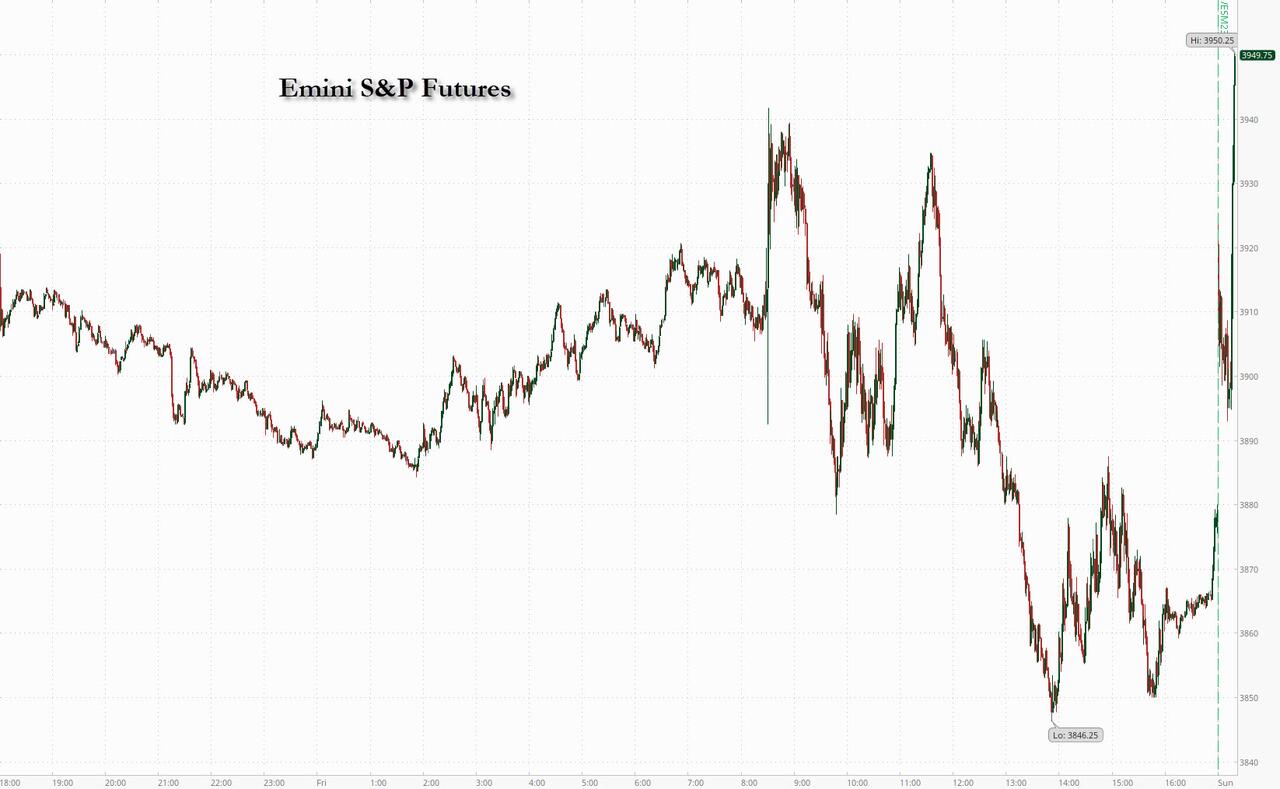

6:10pm ET Update: Futures have opened for trading sharply higher, with bitcoin and precious metals also spiking amid rising expectations of either some sort of bank system bailout/backstop or, more likely, an end to the Fed’s hiking cycle.

Echoing what the WaPo reported in an earlier trial balloon, Bloomberg writes that the Fed and the Treasury Department are preparing emergency measures to shore up banks and ensure they can meet potential demands by their customers to withdraw money.

As reported earlier, the Fed is planning to “ease the terms” of banks’ access to its discount window, giving firms a way to turn assets that have lost value into cash without the kind of losses that toppled SVB’s Silicon Valley Bank (as we noted earlier, the access to the Discoint Window was never an issue, what was is the stigma associated with using it and the likelihood that depositors will flee the moment it becomes public).

Additionally, the Fed and Treasury are also preparing a program to backstop deposits using the Fed’s emergency lending authority.

The use of the Fed’s emergency lending authority is for “unusual and exigent” circumstances, and signals that US regulators view the spillovers from SVB’s collapse as a sign of systemic risk in markets. Bloomberg adds that the FDIC will need to declare a system risk exception in order to insure the uninsured depositors, but we doubt that will be an issue.

The emergency lending facility is a Depression-era statute in the Federal Reserve Act that allows the central bank to make loans directly. The Fed is required to establish that borrowers were unable to obtain liquidity elsewhere. Using the emergency authority requires a vote by the Fed’s board and approval from the Treasury secretary.

Meanwhile, as reported previously, some banks began drawing on the discount window Friday, seeking to shore up liquidity in a panicked frenzy as widespread liquidations on Friday saw many regional banks lose as much as half of their market cap before recovering.

Amid speculation of yet another taxpayer funded bailout – and a guaranteed end to the Fed’s rate hikes and potential return of QE – stock futures jumped above 3900…

…. with gold and bitcoin surging too.

* * *

4:30pm ET Update: It’s getting to the point where every new “proposal” or “idea” being thrown about is worse than the previous one (or maybe this is just how the clueless LGBTQ equity-focused Fed is doing trial balloons on a Sunday afternoon. Shortly after the WaPo reported that the Fed is “seriously considering safeguarding all uninsured deposits at Silicon Valley Bank”, BBG is out with a report that the Federal Reserve is also “considering easing the terms of banks’ access to its discount window, giving firms a way to turn assets that have lost value into cash without the kind of losses that toppled SVB Financial Group.”

Such a move would increase the ability of banks to keep up with demands from depositors to withdraw, without having to book losses by selling bonds and other assets that have deteriorated in value amid interest-rate increases — the dynamic that caused SVB to collapse on Friday.

The report goes on to note that as many had expected, some banks began drawing on the discount window Friday, seeking to shore up liquidity after authorities seized SVB’s Silicon Valley Bank, which is precisely why it is bizarre that this is even news: after all, the Discount Window has always been opened, and the fact that banks hate to use it has nothing to do with “ease of access” and all to do with the stigma of being associated with the discount window. Just recall how banks that were revealed to have used the discount window around Lehman’s failure saw accelerating bank runs.

Or maybe the Fed’s thinking goes that while it would be too late to save SIVB, other banks would somehow boost confidence of their depositors by yelling from the rooftops: “Hey, look at us, we are well capitalized: we just borrowed $X billion from the Fed’s Discount Window.”

Needless to say, the mere rumor that regional bank XYZ has been forced to access this “last ditch” funding facility will result in all its depositors fleeing, which is why we once again ask: after “fixing” Ukraine’s Burisma, is that polymath genius Hunter Biden now in charge of US bank bailout policy?

"Hey, let's stuff all the regional banks into the stigmatizing facility that accelerated the global financial crisis" – Hunter Biden https://t.co/HM2PBiztDG

— zerohedge (@zerohedge) March 12, 2023

* * *

3:00pm ET Update: In a reversal of what Janet Yellen said just hours ago, WaPo reports that federal authorities are “seriously considering safeguarding all uninsured deposits at Silicon Valley Bank” – and by extension any other bank on the verge of failure – and are weighing an extraordinary intervention to prevent what they fear would be a panic in the U.S. financial system. Translation: bailout of all depositors, not just those guaranteed by the the FDIC (<$250K).

Officials at the Treasury Department, Federal Reserve, and Federal Deposit Insurance Corporation discussed the idea this weekend, the people said, with only hours to go before financial markets opened in Asia. White House officials have also studied the idea, per two separate people familiar with those discussions. The plan would be among the potential policy responses if the government is unable to find a buyer for the failed bank.

While selling SVB to a healthy institution remains the preferred solution – as most bank failures are resolved that way and enable depositors to avoid losing any money – there have been several reports that no big bank has stepped up as of yet, leaving the government/Fed as the only option.

As reported earlier, the FDIC began an auction process for SVB on Saturday and hoped to identify a winning bidder Sunday afternoon, with final bids due at 2 p.m. ET.

Some more from the WaPo report:

Although the FDIC insures bank deposits up to $250,000, a provision in federal banking law may give them the authority to protect the uninsured deposits as well if they conclude that failing to do so would pose a systemic risk to the broader financial system, the people said. In that event, uninsured deposits could be backstopped by an insurance fund, paid into regularly by U.S. banks.

Before that happens, the systemic risk verdict must be endorsed by a two-thirds vote of the Fed’s Board of Governors and the FDIC board along with Treasury Secretary Janet Yellen. No final decision has been made, but the deliberations reflect concern over the collateral damage from SVB’s collapse and authorities’ struggle to respond amid limits on their powers implemented following the 2008 financial bailouts.

“We’ve been hearing from those depositors and other concerned people this weekend. So let me say that I’ve been working all weekend with our banking regulators to design appropriate policies to address this situation,” Yellen said on the CBS program “Face the Nation.”

But more importantly, the WaPo report contradicts what Yellen said just a few hours earlier, namely that “during the financial crisis, there were investors and owners of systemic large banks that were bailed out . . . and the reforms that have been put in place means we are not going to do that again,”

This suggests that in just a few short hours, officials and regulators peaked behind the scenes and realized just how bad a potential bad crisis could be and have made a 1800 degree U turn.

The result: any erroneous higherer for longerer narrative spewed by some self-appointed experts has just blown up, and what is about to be unleashed is another vast liquidity wave, something that bitcoin clearly is starting to anticipate.

* * *

1:15pm ET Update: In a throwback to the legendary “Lehman Sunday”, when dozens of credit traders did an ad hoc CDS trading and novation session on the Sunday ahead of the bank’s Chapter 11 filing to minimize the chaos and fallout from the coming bankruptcy, Bloomberg reports that the FDIC kicked off an auction process late Saturday for Silicon Valley Bank, with final bids due by Sunday afternoon.

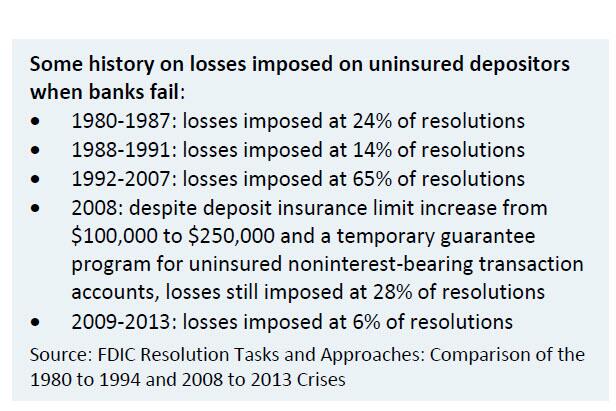

The FDIC is reportedly aiming for “a swift deal” but a winner may not be known until late Sunday. Bloomberg also reported that the regulator is racing to sell assets and make a portion of clients’ uninsured deposits available as soon as Monday; the open questions are i) whether there will be a haircut and ii) how big it will be. A table from JPM’s Michael Cemablest below shows historical haircuts on uninsured depositors in previous bank crises.

We get a slightly more positive vibe from a Reuters report according to which “authorities are preparing “material action” on Sunday to shore up deposits in Silicon Valley Bank and stem any broader financial fallout from its sudden collapse.”

Details of the announcement expected on Sunday were not immediately available. One source said the Federal Reserve had acted to keep banks operating during the COVID-19 pandemic, and could take similar action now.

“This will be a material action, not just words,” one source said. Earlier, U.S. Treasury Secretary Janet Yellen said that she was working with banking regulators to respond after SVB became the largest bank to fail since the 2008 financial crisis.

As fears deepened of a broader fallout across the U.S. regional banking sector and beyond, Yellen said she was working to protect depositors but ruled out a bailout.

“We want to make sure that the troubles that exist at one bank don’t create contagion to others that are sound,” Yellen told the CBS News Sunday Morning show. “During the financial crisis, there were investors and owners of systemic large banks that were bailed out … and the reforms that have been put in place means we are not going to do that again,” Yellen added.

Meanwhile, more than 3,500 CEOs and founders representing some 220,000 workers signed a petition started by Y Combinator appealing directly to Yellen and others to backstop depositors, warning that more than 100,000 jobs could be at risk.

Reuters also reports that the FDIC was trying to find another bank willing to merge with SVB:

“Some industry executives said such a deal would be sizeable for any bank and would likely require regulators to give special guarantees and make other allowances.”

That said, the longer we wait without some resolution the more likely it is that SVB’s unsecured depositors will get pennies on the dollar, according to the following (unconfirmed) reporting from Chalie Gasparino: “Bankers increasingly pessimistic a single buyer will emerge for SVB, laying out options for clients w money in there: 1-ride it out. 2-sell deposits for around 70-80 cents on dollar to other financial players; borrow against deposits jpmorgan at 50 cents on dollar.”

BREAKING: Bankers increasingly pessimistic a single buyer will emerge for SVB, laying out options for clients w money in there: 1-ride it out. 2-sell deposits for around 70-80 cents on dollar to other financial players; borrow against deposits @jpmorgan at 50 cents on dollar

— Charles Gasparino (@CGasparino) March 12, 2023

The FDIC previously said the agency has said it will make 100% of protected deposits available on Monday, when Silicon Valley Bank branches reopen.

There was also news for those whose money remains frozen at SIVB. BBG notes that tech lender Liquidity Group is planning to offer about $3 billion in emergency loans to start-up clients hit by the collapse of Silicon Valley Bank.

Liquidity has about $1.2 billion ready in cash to make available in the coming weeks, Chief Executive Officer and co-founder Ron Daniel said in an interview on Sunday. The group is also in discussions with its funding partners, including Japan’s Mitsubishi UFJ Financial Group Inc. and Apollo Global Management Inc., to offer an additional $2 billion in loans, he said.

“By helping the companies to survive now, I’m hoping some of them would succeed and come back to us in the future,” Daniel said. “We’re nurturing our future clients.” A typical loan will be a one-year facility of $1 million to $10 million, or as much as 30% of the balances held with SVB, Daniel said. The priority is to help companies meet payroll expenses.

The fate of other SVB-linked entities appears to be somewhat rosier. Bloomberg reports that Royal Group, an investment firm controlled by a top Abu Dhabi royal, is considering a possible takeover of the UK arm of Silicon Valley Bank following its collapse last week, according to people familiar with the matter. The conglomerate, chaired by United Arab Emirates National Security Adviser Sheikh Tahnoon bin Zayed Al Nahyan, is discussing a potential buy-out through one of its subsidiaries.

Ọmọ Oòduà Naija Gist | News From Nigeria | Entertainment gist Nigeria|Networking|News.. Visit for Nigeria breaking news , Nigerian Movies , Naija music , Jobs In Nigeria , Naija News , Nollywood, Gist and more

Ọmọ Oòduà Naija Gist | News From Nigeria | Entertainment gist Nigeria|Networking|News.. Visit for Nigeria breaking news , Nigerian Movies , Naija music , Jobs In Nigeria , Naija News , Nollywood, Gist and more