Nigeria has instituted legal action in a London court against American banking and financial service group, JP Morgan Chase, claiming over $1.7 billion in damages over its role in the disputed 2011 Malabo oil deal, as the hearing commences on Wednesday.

The civil suit which was filed at the British courts in 2017, is concerning the $1.3 billion acquisition of an oil block prospecting licence OPL 245 by oil majors, Shell and Eni, which has also been at the centre of the ongoing legal battle in Milan and the UK.

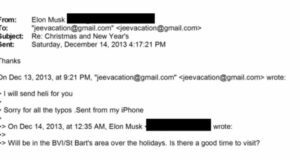

The Federal Government had earlier accused JP Morgan of gross negligence in its decision to transfer funds paid by Shell and Eni into an escrow account to a company controlled by Nigeria’s former Minister for Petroleum, Dan Etete, instead of paying into a government account and without conducting sufficient due diligence.

According to Reuters, the damages being sought for by Nigeria include the estimated $875 million paid in 3 installments in Etete’s Malabu Oil account, plus interest, taking the total to over $1.7 billion, with the Federal Government asking JP Morgan to make these transfers as part of the oilfield sale.

A Nigerian spokesman said that JP Morgan was on clear notice that the payments put its customer, the Federal Republic of Nigeria, at risk of being defrauded which was what, indeed, happened.

What JP Morgan is saying about Nigeria’s allegation

A spokesman for the bank said, “J.P. Morgan is confident that it acted appropriately in making these payments, which were authorised by senior representatives of the Nigerian government, and only processed following extensive engagement with law enforcement and other agencies and courts. We will robustly defend against this claim.’’

What Eni is saying

The 2 oil majors involved in the deal, Shell and Eni, were not listed as parties to the lawsuit instituted by Nigeria at the London High Court.

Although declined to comment on the case, Eni in an email said, “Eni was finally acquitted following the trial in Milan since there was no case, so we have nothing to add with regards to the OPL 245 deal and to the London trial, which doesn’t involve Eni.”

What you should know

- This controversial oil deal actually started about 24 years ago, when the late former military president, Sani Abacha, awarded the offshore oilfield licence, OPL 245, to Malabu oil, owned by Dan Etete.

- According to reports, the about $2 million alleged to have been paid by Etete for the oil block, was widely viewed by industry experts as too low given the block was expected to yield billions of dollars of crude, although it remains undeveloped.

- In 2011, Shell and Eni paid $1.3 billion to the Nigerian government for the acquisition of an oil block prospecting license. However, it was alleged that about $1.1 billion of that amount ended up in the account of Malabo Oil and Gas, which was owned by the then Petroleum Minister, Dan Etete, and was used to pay political bribes.

- Shell and Eni have, however, consistently denied being aware that the money would be used as bribes, but a report alleged that senior Shell executives were briefed on how the money would be used.

- In the related Italian case in Milan, Shell, Eni, and its executives were on trial from 2018 to 2021. Italian prosecutors alleged the companies paid $1.1 billion in bribes to Nigerian officials and others through the OPL 245 deal.

- A panel of judges acquitted the companies and executives, who all denied any wrongdoing, last March. Prosecutors have appealed the ruling.

- Also in May 2020, a UK court dismissed a $1.1 billion lawsuit instituted by the Nigerian government against Shell and Eni, with respect to a dispute over the OPL 245 oil field on the grounds that the UK court did not have jurisdiction to try the lawsuit.

Ọmọ Oòduà Naija Gist | News From Nigeria | Entertainment gist Nigeria|Networking|News.. Visit for Nigeria breaking news , Nigerian Movies , Naija music , Jobs In Nigeria , Naija News , Nollywood, Gist and more

Ọmọ Oòduà Naija Gist | News From Nigeria | Entertainment gist Nigeria|Networking|News.. Visit for Nigeria breaking news , Nigerian Movies , Naija music , Jobs In Nigeria , Naija News , Nollywood, Gist and more